One of the main reasons that car insurance rates are going up is the increase in distracted driving, which has led to a significant jump in vehicular deaths and accidents in the last five years. Despite most states in the country now having laws barring the use of your phone for talking or other tasks…Read more

What is Gap Insurance?

It’s the nightmare scenario for any new car buyer. You drive it off the lot and a few days later another driver runs a red light, smashing into your car and severely mangling most of the front end and irreparably damaging the frame – essentially totaling the vehicle. Luckily nobody was injured, but will insurance…Read more

Auto Insurance Rates Are Going Up

Get ready to pay more for auto insurance. A combination of factors is pushing car insurance premiums up across the country. The reasons are varied, but they all combine to result in higher premiums for car owners from coast to coast. Here’s what’s behind the coming rate hikes – and some tips on how you…Read more

Student Driver Discount Insurance

Student-Driver Discount Insurance helps you save while they learn Your child is away at school for the year and not using the family car regularly, so you may think it’s time to drop them from your auto insurance policy. That is certainly an option when your child leaves home, but the student-driver away discounts can…Read more

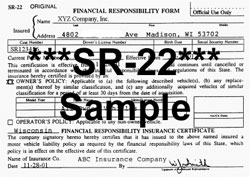

The Difference Between an SR22 and FR44

I am often asked the difference between an SR22 and an FR44. SR22 Insurance An SR22 is required by the Virginia DMV if you have tags on a car and it’s not insured. Regardless, if you are driving the car or not, you have to maintain insurance as long as you still have tags on…Read more

How Teen Drivers Affect Your Car Insurance

When teens are about to turn 16, chances are they’re dreaming of carefree days behind the wheel with the windows down and the wind in their hair. As the parent of a new teen driver, your dreams may be clouded with worry and higher insurance rates. Talking to your insurance agent is a first step…Read more

How Does My Marital Status Affect My Car Insurance Rate?

Being single has its advantages. A lower rate on your car insurance isn’t one of them. Your marital status is one of several factors that car insurance companies look at when they calculate your rate. What the companies are trying to do is predict how big of a risk you are. They’re trying to determine…Read more

Multi-policy Discounts Can Save a Bundle on Auto Insurance Rates

Are you looking for easy ways to save time and money? Then, you should learn more about combining the various types of insurance you have with one insurance company to take advantage of a multi-policy discount. You may qualify for a multi-policy discount if you have one or more cars and an apartment or home.…Read more

How Can I Save Money On Car Insurance With a Teen Driver?

Ah yes, your teen is finally behind the wheel, which allows you to hang up your hat as the resident chauffer. But in addition to that newfound sense of freedom for both parent and teen, comes a new pinch in the pocketbook. It’s true, parents of teen drivers typically incur an increase in their car…Read more

What Affects My Car Insurance Rate?

There are many mysteries in the world. How your credit rating is determined is one of them. The Loch Ness monster is another. What affects your auto insurance rates is a third. Knowing what affects your auto insurance rates – and how to get the best rate you possibly can – is not as hard…Read more