After a video surfaced showing a Minnesota police officer kneeling on George Floyd’s neck, many residents took to the streets. While most engaged in peaceful protest, many resorted to violence. The result was extensive property damage to local businesses. The question is, will insurance pay for repairs and lost of income due to a riot?…Read more

Texting While Driving Tickets Will Increase Insurance Premiums

One of the main reasons that car insurance rates are going up is the increase in distracted driving, which has led to a significant jump in vehicular deaths and accidents in the last five years. Despite most states in the country now having laws barring the use of your phone for talking or other tasks…Read more

Does Business Insurance Cover Coronavirus?

COVID-19 is forcing businesses to face a number of risks, liability and insurance implications. Companies could seek coverage for a variety of claims stemming from the outbreak, including workers’ compensation, business interruption, liability and more. And, now that it is a pandemic, the economic fallout may be expansive – hitting your company’s operations in the…Read more

Employer Guide for Dealing with the Coronavirus

As the outbreak of the 2019 novel coronavirus gains momentum and potentially begins to spread in North America, employers will have to start considering what steps they can take to protect their workers while fulfilling their legal obligations. Employers are in a difficult position because it is likely that the workplace would be a significant…Read more

Why Are Commercial Insurance Premiums Increasing?

A new report by Willis Towers Watson predicts that most commercial insurance lines will see increases in 2020 as the market continues to harden almost across the board, with the only exception being workers’ compensation. Overall, 19 commercial lines are expected to see price increases according to the report, with property, umbrella, and public company…Read more

Homeowner’s Liability Goes Beyond Your Home

One misconception about homeowner’s liability insurance coverage is that it only covers incidents in the home. In fact, the coverage under the comprehensive personal liability portion of your homeowner’s policy is not limited by location. It is, however, limited by the liability caps on your policy. We can show you where that is stated. Here…Read more

Professional Liability Insurance

People often think of professional liability insurance (aka..E&O Insurance) as something only doctors and lawyers need. The truth is that anyone in any profession can be sued for making bad decisions. Standard business general liability insurance policies do not cover liability for professional mistakes. They will not cover errors that cost someone else money without…Read more

Does Insurance Cover Business Disruption due to Dorian?

What happens if your business suffers property damage or a supply chain disruption and is forced to stop operations either fully or partially? Will your insurance cover the work stoppage or slowdown? It is important to understand how your insurance can protect you from the resulting financial loss. In addition to potential recovery for property…Read more

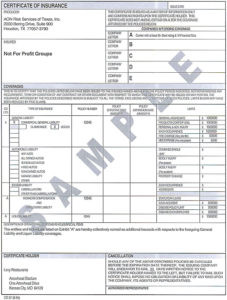

What is a Certificate of Insurance?

When stores lease real estate spaces or construction firms win jobs, the party on the other end usually has a very specific set of requirements. One of the main requirements is that the tenant, contractor or borrower show proof that he or she has adequate insurance. Copies of insurance documents may be sufficient. But, not…Read more

Review Insurance When Having a Baby

Expecting a baby is one of the most joyous experiences in life. As you prepare your nursery, don’t forget to talk to your insurance agent to make sure your coverage reflects the change in your growing family. Below are a few pointers. Health insurance Before your baby is even born, review your coverage and make sure you…Read more

- « Previous Page

- 1

- 2

- 3

- 4

- 5

- 6

- …

- 11

- Next Page »