Umbrella insurance provides protection beyond standard coverage, and they are available in increments of a million dollars. Sometimes known as an excess liability or personal liability insurance, umbrella insurance doesn’t stand alone. Instead, it adds another layer of liability protection on top of the liability built into other policies you have, including auto, homeowner’s, or…Read more

Types of Insurance a Small Business Needs

If you are just getting a business off the ground, have bought equipment, and started hiring employees, insurance should be top of mind. There are four types of insurance that most small businesses purchase to protect themselves, and without them, one accident or oversight could leave you with liabilities you may not be able to…Read more

Professional Liability Insurance

A majority of companies are leaving themselves exposed in one crucial area as they take on high-end professional services work. As more companies’ work is intangible, many firms are missing a critical element of protection for their professional services. Professional liability insurance in the past was mainly purchased by architects, accountants and lawyers, but with…Read more

Dog Bites and Homeowners Insurance

There are some 63 million dogs in the U.S. and while they make for great companions and help keep our homes safe from intruders, they can also be a significant liability. About 4.5 million people suffer dog bites every year, according to the Centers for Disease Control and Prevention. Of that number, about 885,000 need…Read more

Protect Your Business with a Business Owners Policy (BOP)

Imagine the following costly scenarios: One of your staff embezzles $80,000 from your company. A visitor to your office slips and falls after the floor has been mopped, breaking his leg. There’s a fire in your warehouse that damages half of your $2 million inventory. As a small business owner, you would likely be reeling…Read more

What is Umbrella Insurance?

Umbrella insurance is designed to protect you from liability exposures that your homeowner’s and auto insurance policies do not, as well as fill in gaps in coverage when the limits of these policies are exhausted. Lawsuits are filed daily against ordinary folks, with reasons ranging from the frivolous to the justified. More often than not,…Read more

Dog Owners Liable When Their Pets Bite

There were over 90 million dogs residing in people’s homes across the United States in 2018, according to the American Pet Products Association. Unfortunately, there are more than 5 million dog bites reported each year, according to the Centers for Disease Control. Of that amount, almost 900,000 require medical care, and about 50% of those…Read more

Homeowner’s Liability Goes Beyond Your Home

One misconception about homeowner’s liability insurance coverage is that it only covers incidents in the home. In fact, the coverage under the comprehensive personal liability portion of your homeowner’s policy is not limited by location. It is, however, limited by the liability caps on your policy. We can show you where that is stated. Here…Read more

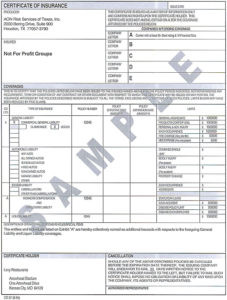

What is a Certificate of Insurance?

When stores lease real estate spaces or construction firms win jobs, the party on the other end usually has a very specific set of requirements. One of the main requirements is that the tenant, contractor or borrower show proof that he or she has adequate insurance. Copies of insurance documents may be sufficient. But, not…Read more

Business Growth Will Lead to Increased Risk

As the economy continues expanding, companies need to be careful about properly managing their risk, according to a report by Advisen Inc., an insurance research and data firm. Increased activity typically means proportionally additional losses. For example, more trucks driving more miles will inevitably result in more accidents. However, there are other kinds of risk…Read more

- 1

- 2

- 3

- 4

- Next Page »