Insurance is a very special industry. The whole value of an insurance policy of any kind resides within a simple promise: The promise to pay a potentially large benefit in the event of a claim. But the claim could happen many, many years in the future. For example, life insurance policies routinely pay no benefit for several decades – during which time the policy owner is paying premiums.

Is the insurance company capable of keeping that promise? Will the company even be around after many years? What if there were a major disaster or other event that would require a company to pay many claims at the same time? Does the company have the assets and liquidity to pay claims as promised? Genworth is the latest example of why it’s so important to work with a financially sound insurance company.

The average consumer has no direct way of knowing for sure. Although the overall record of the insurance industry is excellent – no legitimate life insurance claim, to name one line, has ever gone unpaid in the United States just because an insurance company became insolvent. But the fact is that all insurance claims and all annuity benefits are subject to the claims-paying ability of the insurance company. Few consumers are actuaries, though – and nobody wants to have to pour through a company’s financials just to buy a simple life insurance policy.

That’s where the insurance company ratings agencies come in. These are third parties who themselves look at a variety of insurance company metrics, such as:

- The expected future liabilities of a company and when they come due.

- The reliability of cash flows from premiums.

- The safety, stability and liquidity of the insurance company’s pool of reserves.

- The quality of underwriting and whether the pool of insured for a particular company is substantially higher-risk than normal

- The amount of reinsurance in place.

In short, they look at anything that may impact the ability of an insurance company to stay solvent in times of a major crisis. They may also conduct “stress tests” of a company’s finances, looking at what may happen, for example, if a life or health insurance company had to deal with a major outbreak of influenza, or if a property and casualty company had to deal with a Category 5 hurricane striking the Eastern Seaboard in the same year as another Category 4 or 5 hurricane struck New Orleans or Miami.

They also look at what may happen in very difficult economic conditions, such as a major recession impacting premiums and new business, or a sustained period of low interest rates, which would depress the earnings an insurance company would receive from its portfolio – a critical component for many insurance companies – particularly those with longer time horizons between receipt of premiums and payout of benefits.

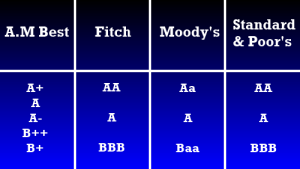

Each of these insurance company ratings agencies assigns a letter grade as a kind of market shorthand for the strength and stability of any rated insurance company. Other ratings agencies, such as Fitch and Standard & Poor’s have a similar protocol, though their precise terminology vary somewhat.

Companies with higher ratings may command higher premiums. There is less risk in insuring with strong companies than with insurers with less stable capital structures.

Moreover, some errors and omissions policies may not provide protection to insurance agents in cases arising from lower-rated insurance companies – say, rated B+ or worse.

What Happens When an Insurance Carrier Becomes Insolvent?

There is no bank guarantee available on insurance products of any kind, nor is there any kind of federal insurance available to back insurance companies that get into trouble. There is no Federal FDIC for insurance companies. Instead, each state maintains a guaranty association to administer a relief fund to protect policyholders in life and health insurance companies, up to certain limits. Contact your state’s insurance commissioner for more information on your state guaranty fund and limits, or visit the National Organization of Life & Health Insurance Guaranty Associations.

Overall, however, the higher the rating from A.M. Best, Fitch or Standard and Poor’s, the lower your risk.