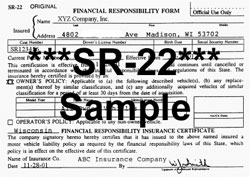

I am often asked the difference between an SR22 and an FR44.

SR22 Insurance

An SR22 is required by the Virginia DMV if you have tags on a car and it’s not insured. Regardless, if you are driving the car or not, you have to maintain insurance as long as you still have tags on the car. The Virginia DMV randomly checks for active insurance so make sure your policy is paid to date. Alabama has recently implemented a real time insurance verification system so look for more states to introduce this as well.

FR44 Insurance

An FR44 is required if you obtain a DUI or DWI. With an FR44 your liability limits must be equal to or greater than $50,000 per person / $100,000 per accident / $40,000 property damage.

In either case, DMV imposes fines for both SR22’s and FR44’s. The electronic filing, completed by an insurance company, lets DMV know you have insurance and if the insurance policy is cancelled for any reason, non-payment, company cancellation or insured cancellation, the DMV will be immediately notified. Your drivers license is then suspended and the timing for the SR22 or FR44 will be reset. Additional fines are also imposed.

What’s the cost for an SR22 or FR44?

Most standard companies, such as State Farm, Allstate, Nationwide Mutual, Travelers or The Hartford will not insure driver’s who require an SR22 or FR44. However, there are insurance companies who will insure driver’s in this situation and some companies don’t charge any extra premium for filing the SR22 or FR44.

How Long Do I Need an SR22 or FR44?

DMV determines the amount of time required to maintain an SR22 or FR44 so make sure you ask the DMV representative when you pay your fines. Most electronic filings are required for between 1 and 5 years.

The Andrew Agency

If you live in Virginia and need an SR22 or FR44 or for more information contact The Andrew Agency at (804) 320-2886. The Andrew Agency will let you know what options are available and exactly how much your insurance will cost.